Update process and streamline workflows with technology Offering a more comprehensive benefits package could help widen your range of candidates. On top of that, candidates are looking for employers who can offer more modern voluntary benefits like child care, mental health resources, and student loan forgiveness. Insurers who can offer employees more flexibility in their work life will have a better chance of attracting talent. Over a year into the “post” pandemic limbo we now find ourselves in, job seekers rank flexible work arrangements as one of their top three priorities while job hunting. If one good thing came from the pandemic, it’s the switch organizations made to offer their employees more flexible hours and remote work options. Offer workplace flexibility and other modern benefits There’s no clear answer, but here are a couple of things insurance experts can do to try and attract talent from younger generations. So how do you go about recruiting younger talent when younger generations are reluctant to bite? The truth is, for various reasons, young people just aren’t jumping at the chance to work in insurance. That may seem like the obvious answer but, unfortunately, it’s a lot easier said than done.

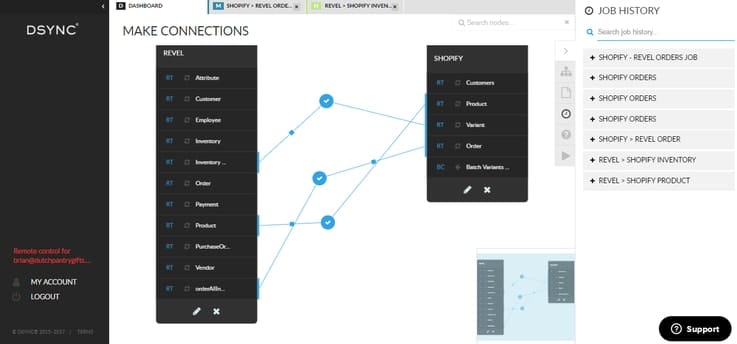

The insurance talent pool is aging out, what do we do? Hire some younger people, of course. Path 2: Open the talent pool to attract younger talent Automation backed technology solutions can help relieve mega producers of the tedious, repetitive duties that don’t return an investment, helping them manage their large number of clients more efficiently. If you do choose this route and now have a bunch of mega producers who are responsible for more clients than ever, they’re going to need resources to help them out. Technology helps mega producers manage larger books of business

Your agency better be prepared to offer more favorable compensation benefits to keep everyone happy and willing to work. By putting all of the responsibility onto a handful of producers, you can expect that they’ll want more in return. Eventually, these people will retire and you will be right back to square one.Īnother downside to this option is the amount of resources your agency will likely have to put into making it work. is just under 50 and even someone with a title as superhuman sounding as “mega producer” can’t live and work forever. The average age of an insurance agent in the U.S. The main one: It’s not a long-term solution. This path comes with a couple of obvious issues. Those who remain may choose to take on these books of business, giving them more clients than usual and resulting in an influx of mega producers. As agents retire out of the industry, they leave behind large books of business. One way to approach the insurance industry talent crisis is to simply offload more responsibility onto the producers who still remain. Path 1: Put more responsibility on current insurance producers, aka the “mega producer” To avoid a grim fate, we’ve outlined three paths carriers and agencies can take to ensure future success as the talent pool shrinks. This has left a huge talent gap in the insurance space, which carriers and agencies are struggling to fill.Īnd with the youngest of the baby boomer generation now reaching retirement age, if insurance experts can’t find a solution to this gap soon, they’ll quickly find themselves up the creek without a paddle. While baby boomers continue to retire in waves, millennials and younger generations aren’t exactly lining up to fill their spots. The great resignation, the war for talent, whatever you want to call it, the talent crisis has plagued the insurance industry for years.

0 kommentar(er)

0 kommentar(er)